Silver’s Shine, Gold’s Glory

I don’t know if you saw it, but something major just happened in the markets… Gold just smashed through $3,600 an ounce! And silver didn’t just tag along — it busted past $40, a line in the sand that traders have been watching for years.

If you’ve been holding metals through this grind, congratulations on the big win. But here’s the kicker: We’re still in the early innings of this bull market, so don’t go anywhere yet…

I know what you’re thinking — prices are already up a lot. Shouldn’t we be cautious here?

But history tells us that when precious metals break out of long-term resistance levels, the follow-through can be explosive.

And while gold is the steady heavyweight that always does its job, silver is the wiry brawler that overdelivers when the real fight begins.

That’s why smart investors aren’t choosing between the two. They’re buying both — but they’re especially leaning into silver and the stocks that mine it.

The Case for Precious Metals Right Now

Let’s start with the obvious: Why are gold and silver running in the first place?

The short answer: Everything’s breaking, and metals don’t break.

Central banks are still hoarding gold like it’s going out of style.

Governments are running record deficits and weakening their currencies.

Geopolitical flashpoints are multiplying.

Inflation may not be at 2022 levels, but it’s still higher than the “2% forever” fantasy we were promised.

Despite that inconvenient fact, the Fed is all but guaranteed to cut interest rates this month, further stoking the inflation caused by excessive spending.

And on top of all that, silver is quietly becoming the most important industrial metal of the 21st century…

Between solar panels, EVs, and AI-driven power demand, silver is being consumed faster than new supply can come online.

Here’s a simple list of reasons why metals have so much momentum left:

- Central banks are still net buyers of gold, with no slowdown in sight.

- Silver demand for green energy and tech applications is hitting all-time highs.

- New mining projects take years to permit and build, leaving supply tight.

- Fiat currencies are being debased at warp speed by reckless fiscal policy.

- Investors are rediscovering metals as a hedge against both inflation and instability.

That combination makes for the kind of setup traders dream about: limited downside, massive upside.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Gold vs. Silver: Which Delivers More Punch?

Gold is always the foundation. It’s money that can’t be printed, a safe haven that never goes out of style.

But silver? Silver is where fortunes are made in bull markets like this one.

That’s because silver’s market is tiny compared with gold’s (which is tiny compared with equity markets).

When money floods into silver, prices don’t just rise — they leap.

The gold-to-silver ratio has already tightened from its ridiculous highs well above 80, but history suggests it can fall into the 30s or even the 20s in a strong cycle.

That means silver has much more room to run — think $100 per ounce or higher if gold’s rally carries on, which it’s all but guaranteed to do.

And the best way to magnify those gains is with miners…

The big boys give you leverage to the metals themselves. The juniors?

They’re the lottery tickets — except this lottery actually has odds you can measure. Some of them are sitting on verified resources worth far more than their current market caps.

The Opportunity in Miners: Big and Small

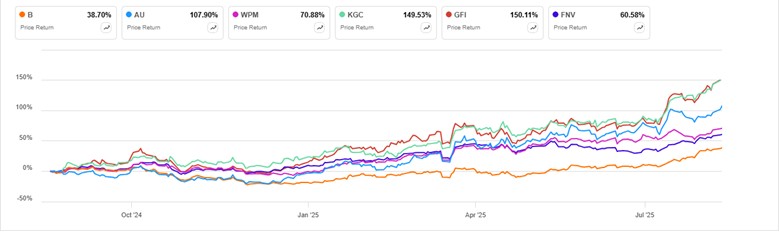

The unfortunate part of this story, though, is that you’re no longer the earliest to the trade. Wall Street has already sniffed this one out.

Retail is still sitting this one out, but the big funds are starting to buy up major producers, and you can see it in the stock charts.

But there are still names flying under the radar — companies with serious resources, strong projects, and leverage to higher prices that hasn’t been fully priced in yet.

So let’s look at four that deserve your consideration…

Avino Silver and Gold: The Steady Climber

You could probably say that Avino Silver and Gold (NYSE: ASM) has been around the block…

This isn’t a fly-by-night company that just popped up. It’s a firm with a long history of mining in Mexico, where its flagship Avino Mine continues to churn out silver, gold, and copper.

But what really makes Avino compelling right now is its scalability…

The company has been steadily expanding production capacity, reinvesting in its mill, and proving up resources.

In a $20 silver world, Avino was an interesting speculation. At $40 silver, it’s practically a cash machine. At $100, it could be a gold mine, if you’ll pardon the pun.

Investors love miners with staying power. And Avino has decades of production ahead and the infrastructure already in place to deliver growth without reinventing the wheel.

Apollo Silver: The High-Grade Play

Apollo Silver (OTC: APGOF) is all about leverage to silver, and it’s hard to find a cleaner pure play…

Its flagship Calico Project in California is one of the largest undeveloped silver resources in the U.S.

We’re talking about a project sitting in a mining-friendly jurisdiction, close to infrastructure, with enormous ounces in the ground.

In a lower-price environment, a project like Calico is “nice to have.”

But in this kind of rally, it suddenly looks like a crown jewel. Capital markets open up. Financing becomes available. And majors start circling, looking for acquisitions.

Apollo also benefits from something few juniors can boast: scalability.

You see, as silver prices keep rising, the economics of Calico improve exponentially.

That makes Apollo a textbook example of the kind of junior that can deliver outsized gains in a precious metals bull market.

Borealis Mining: A Junior With Serious Leverage

Borealis Mining Company Limited (TSX-V: BOGO) is exactly the kind of junior that can turn a strong metals rally into outsized gains for investors.

The company controls the historic Borealis gold-silver district in Nevada, a proven mining jurisdiction where infrastructure, skilled labor, and permitting pathways already exist.

And what makes Borealis compelling is its combination of legacy production history and untapped exploration potential…

The district has produced significant ounces in the past, but modern drilling and modeling suggest there’s still plenty of metal left in the ground.

In a $1,500 gold environment, Borealis was a curiosity — something worth watching but not necessarily a priority.

At $3,600 gold and $40 silver, it’s an entirely different story.

The economics of restarting and expanding operations here are vastly more attractive, and the company has been working to position itself to capture that upside.

With strong management, district-scale potential, and leverage to both gold and silver, Borealis offers precisely the kind of asymmetric payoff profile that makes juniors so exciting in bull markets like this one.

NatBridge Resources: The Digital Wildcard

Then there’s NatBridge Resources (OTC: NATBF) — a new kind of play that straddles the old world of hard assets and the new frontier of digital finance…

NatBridge controls significant verified in-ground gold resources, and it’s pairing them with tokenization through the NatGold digital asset, which is backed 1:1 by those resources.

Think about that for a second:

On the one hand, you’ve got real, NI 43-10-verified gold in the ground. On the other, you’ve got a digital token that makes that gold accessible, divisible, and tradable in ways the physical metal never could be.

If gold is money and silver is leverage, NatBridge is innovation.

It’s a way to own exposure to gold that could also plug into the broader digital asset ecosystem.

That’s not just leverage to price — it’s leverage to an entirely new financial infrastructure.

The Road Ahead: $5,000 Gold and $100 Silver

If you think the move to $3,600 gold and $40 silver was impressive, buckle up.

We’re not even close to the end of this rally. The truth is that we’re closer to the beginning.

And history shows that precious metals bull markets tend to run for years, often overshooting anyone’s expectations before they finally cool off.

So we’re calling this the second inning of a nine-inning game. And if you want to be on the profit express, now is the time to board.

As gold marches toward $5,000 an ounce and silver stakes its claim north of $100, the biggest winners won’t be the ones who sat on the sidelines waiting for a “better entry.”

They’ll be the ones who recognized the breakout, bought the miners, and held on while the world woke up to what was happening.

The Bottom Line

Precious metals aren’t just having a moment — they’re entering a new era…

Gold is reaffirming its role as the ultimate safe haven. Silver is stepping into the spotlight as both a monetary metal and a critical industrial resource.

The majors are already moving. The mid-tiers are starting to run.

And the juniors — the little-known, underpriced names with ounces in the ground — are about to become the stories investors kick themselves for missing.

Avino, Apollo, Borealis, and NatBridge are four ways to get positioned now.

There are more, but these give you exposure to the full spectrum: established producers, promising developers, and innovative disruptors.

Remember, we’ve only just started the second inning. Don’t wait until the scoreboard flashes $5,000 gold and $100 silver to realize the game was winnable all along.

Step up to the plate now — and take your swing at the kind of profits that only come around once in a generation.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube